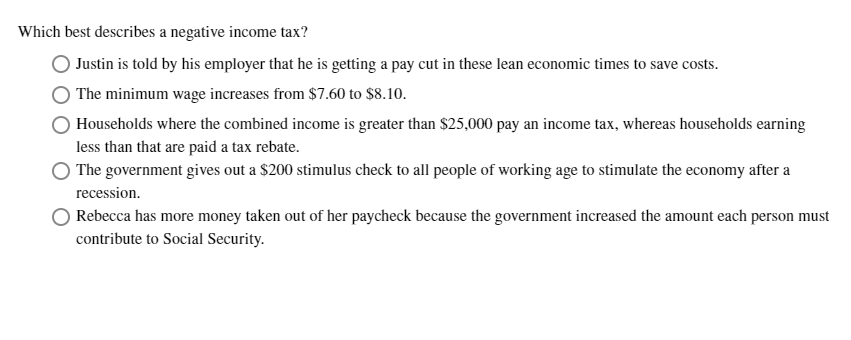

Hich Best Describes a Negative Income Tax

The idea behind a Negative Income Tax NIT is to give poor people money. Which of the following best describes a negative income tax.

Solved Consider A Firm That Is A Monopsony When Hiring Chegg Com

Inequalities in opportunity due to brute luck.

. Best Answer 100 1 rating The sign on depreciation is positi. Individuals and families earning a higher income will pay a tax based on that income while low-income individuals and families receive a subsidy or negative. Which terms best describe sales tax.

1 2026 after which the deduction is reduced to 21875 resulting in an effective tax rate of 16406. A business may end up with a negative income tax liability for a given tax year due to its specific situation. The regular tax and excess profits tax.

In contrast to a standard income tax where people pay money to the government people with low incomes would receive money back from the government. In effect its a kind of income tax that works in reverse. The negative income tax Many economists believe that a more effective way to supplement the income of the poor is through a negative income tax.

The EITC is a government benefit available to workers with low to moderate incomes. One-fifth of adults with an income under 35000 smoked in 2019 while about 7 of those who earned more than 100000 smoked. The idea of negative income tax is novel.

Under this scheme everyone reports his or her income to the government. Negative income tax nit is an alternative to welfare suggested by among other proponents economist milton friedman in his 1962 book capitalism and freedom. Which of the following inequalities does Cohens socialist or radical principle of equality of opportunity address.

Check all that apply. The amount of the payment will vary based on household size and need. A Corporate income is subject to two levels of taxation.

First the tax takes a larger percentage of income. In this example you you would not receive anything back in terms of an income tax refund amount for that tuition and fees deduction. What best describes a negative income tax.

Suppose you have a negative 5000 taxable income and your tuition and fees deduction was 5000. It is possible however to claim a different education tax break in the form of a tax credit. For those who earn below a certain amount like the poverty line the government pays them.

For those who earn below a certain amount like the poverty line the government pays them. Which statement best describes the concept of the double taxation of corporation income. Which of these best describes income tax.

Property taxes are usually determined based on. The corporation makes a 600 distribution to its. Households where the combined income is greater than 25000 pay an income tax whereas households earning less than that are paid a tax rebate Moses received monthly government support to help him care for his children.

As a result a corporation can claim a 375 deduction which results in a permanent tax benefit and 13125 effective tax rate as compared with a 21 corporate rate for tax years beginning after Dec. Second lower-income earners are more likely to smoke. The negative income tax is a way to provide people below a certain income level with money.

What is negative income tax. It reduces the amount of tax you owe based on your income and other qualifying criteria which means you might get a refund even if you didnt pay a significant amount in taxes for the year. The business may have had very little net income or experienced a loss for the tax year meaning that it has no tax liability in that year.

The US already has a program like this that benefits millions and President Donald Trump has proposed. The sign on depreciation is negative because cash is paid for equipment used in operations that are not yet reflected in the cost of goods sold. Which decreases the purchasing power of consumers.

The cigarette tax is regressive on two levels. As a negative consequence of the use of credit by the Federal Government is the use of 831 billion that was spent on tax credits medical care schools energy roads and other construction projects which generated a budget deficit that had to be settled with taxes. You can choose the standard deductiona single deduction at a fixed amountor itemize.

Earned Income Tax Credit is a form of a negative income tax. When a person with no or low income files federal income tax returns he or she will then be eligible for a lump sum payment. Value of the property.

View the full answer Previous question Next question. Everyone who falls below the poverty line receives a state subsidy. Government use of credit increases the total national debt and interest payments.

A calendar-year corporation has negative current EP of 500 and accumulated positive EP of 1000. 1 nit proponents assert that every. However at the bottom of the statement highlighted in green the company posted a positive cash.

This increase in the cost of goods sold is subtracted from net income. A tax deduction is an item you can subtract from your taxable income to lower the amount of taxes you owe. Imagine for example a graduated tax system where income under 100000 is taxed at 10 income between 100000 and 300000 is.

31 2017 and before Jan. An is a tax issued by the federal government on imported goods. JC Penney had a negative net income or loss for the period of 78 million highlighted in red.

An Education You Can Take To The Bank Bliss Business Education Network Marketing Education College

Solved Which Best Describes A Negative Income Tax O Justin Chegg Com

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Comments

Post a Comment